🦷 Yes, you can use your HSA for dental expenses—if you know what qualifies. From cleanings to implants, this guide breaks down which procedures are covered and how to avoid costly mistakes. Read on to make the most of your HSA and protect your smile (and your wallet).

Paying for dental expenses can be tricky, even for those with dental insurance. Fortunately, a health savings account (HSA) can be used for medical expenses and dental costs, including necessary dental procedures and copays.

Benefits of Using an HSA for Dental Expenses

- Optional automatic paycheck withdrawal

- Optional manual contributions, even from someone else on behalf of the account holder

- The money in the account never expires

- Self-employed individuals can also open an HSA

- You are issued a debit card for easy use

- Funds can be used for many different medical, dental, and vision expenses

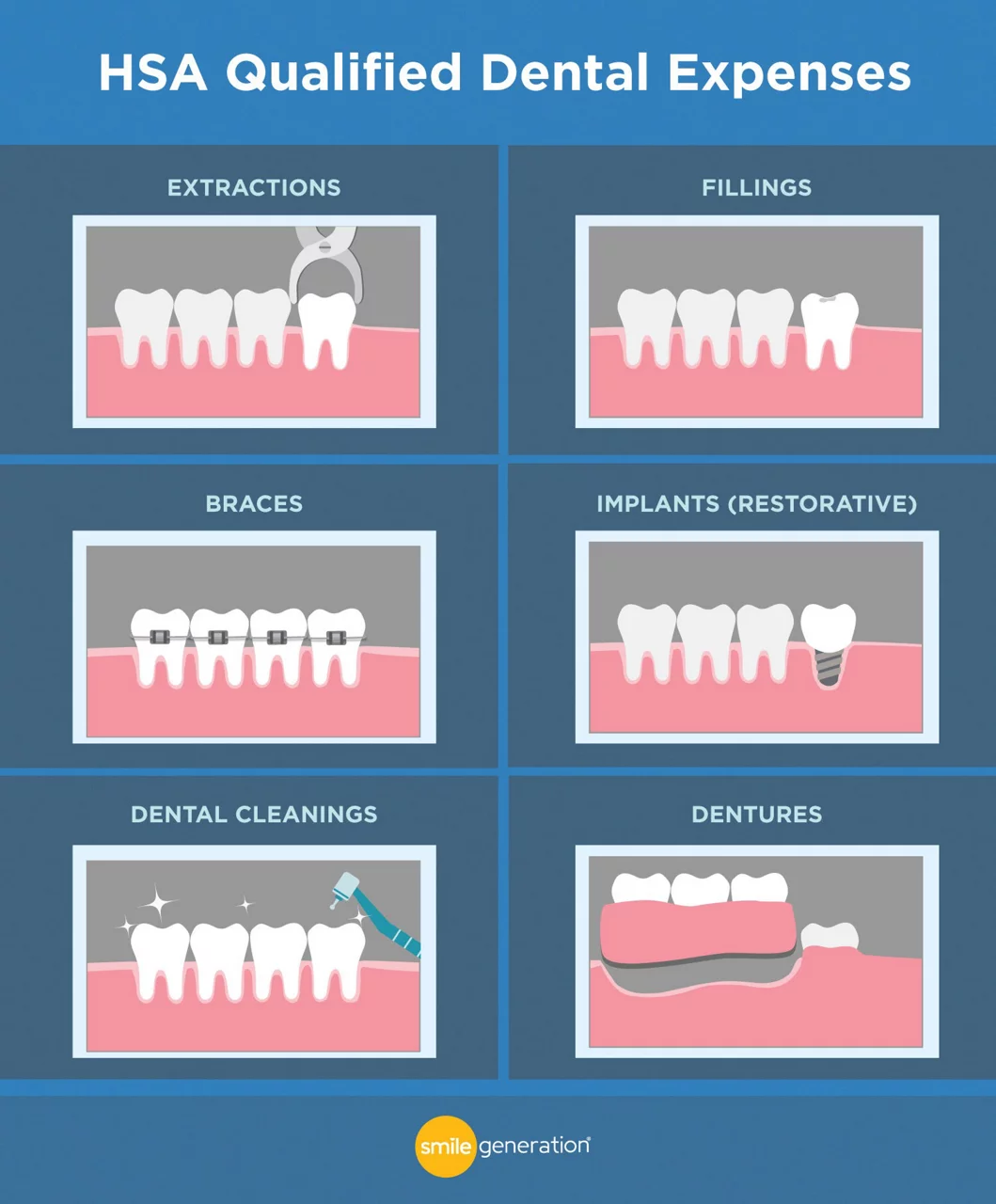

What Dental Expenses Are HSA Eligible?

| Dental Procedure | HSA Eligible? | Notes |

|---|---|---|

| Tooth Extractions | ✅ Yes | Includes wisdom teeth; medically necessary. |

| Dental Fillings | ✅ Yes | Treats cavities and prevents decay. |

| Dental Implants | ✅ Yes | Allowed if restorative, not cosmetic. |

| Braces | ✅ Yes | Improves alignment and bite function. |

| Teeth Cleanings | ✅ Yes | Essential for cavity and gum disease prevention. |

| Dentures | ✅ Yes (if needed) | Covered when needed for eating or talking. |

| Fluoride Treatments | 🚫 No | Not always covered by insurance. |

Read over your HSA information carefully for specific, outlined expenses that are covered. Generally, your health savings account can be used for treatments and procedures that benefit your oral or overall health.

Can You Use HSA for Tooth Extractions?

Yes, tooth extractions costs can be paid for with an HSA. When a tooth needs to be extracted, it is for the mouth's overall health.

In the case of wisdom tooth removal, the extraction prevents the mouth from getting overcrowded with teeth, causing them to misalign, which makes them more prone to developing cavities. Wisdom teeth also cause many issues when they erupt and can become infected and painful.

Can You Use HSA for Tooth Extractions?

Yes, tooth extractions costs can be paid for with an HSA. When a tooth needs to be extracted, it is for the mouth's overall health.

Can You Use HSA for Dental Fillings?

Yes, fillings are a restorative procedure that an HSA covers. If you have tooth decay, having the cavity filled with either gold, porcelain, silver amalgam, or composite resin will seal the hole and prevent bacteria and food debris from getting inside, causing the tooth to decay further.

Can HSA Be Used for Dental Implants?

An HSA can cover dental implants if it is a restorative procedure and not for cosmetic purposes.

Can You Use HSA Funds for Braces?

Yes. While braces benefit your smile, they are also important for oral health. Straight teeth aligned perfectly with the lower or upper teeth are easier to keep clean. Braces also correct overbites and underbites.

Can Your HSA Funds Be Used for a Dental Teeth Cleaning?

Yes. Scraping away hardened plaque is essential for a healthy mouth. Bacteria, found in plaque, feast on the sugars found in the foods you eat and create an acid that eats through the enamel of your teeth. This can lead to tooth decay, gum disease, and tooth loss.

Can You Use an HSA for Dentures?

If dentures are needed for eating and talking because of severe tooth loss, your HSA will cover the expense. However, if you want dentures for purely cosmetic reasons, your HSA will not cover the cost.

Can You Use an HSA for Fluoride Treatments?

Dental insurance does not always cover the cost of a fluoride treatment, even though it greatly benefits your oral health. Fluoride treatments give added protection against developing cavities between visits to the dentist.

What Dental Expenses are NOT HSA Eligible?

You cannot use your HSA funds to pay for procedures that do not directly benefit your health or is considered general health items such as:

floss

toothpaste

mouthwash

Cosmetic Dental procedures are not eligible for HSA funds, including teeth whitening.

However, it is possible to use HSA money on specialty electric toothbrushes or water flossers if you have a written prescription from your dentist.

Tips for Maximizing HSA Funds for Dental Care

- Making monthly contributions to your HSA will keep it growing steadily.

Contribute the max amount you can for each year you work because you cannot contribute once you go on Medicare.

- $4,300 is the 2025 max amount you can contribute as an individual

- $8,500 is the 2025 max amount you can contribute as a family

- After the age of 65, you can withdraw the money for any expense without a 20% fee.

- Getting your HSA through your employer can save you money because your contributions are not subject to Social Security and Medicaid taxes in this case.

Find a Dentist in Your Community

The most important thing is getting the dental care you need to stay healthy. Opening a health savings account is an excellent way to get the oral health care you need while not having out-of-pocket costs. Regular visits to the dentist can make a big difference in the health of your teeth. To find the right dentist, check out Smile Generation's Find a Dentist tool for reviews and descriptions of dentists in your community.

Find your trusted, local dentist today!

HSA for Dental Expenses FAQs

Yes, you can use an HSA for dental implants if the procedure is restorative and not cosmetic.

Yes, HSA funds can be used for dental fillings. Fillings are considered a restorative procedure to treat tooth decay and prevent further damage.

Yes, you can use an HSA for dental care as long as the procedure benefits your oral or overall health. Dental treatments such as cleanings, extractions, fillings, and braces are covered.

No, teeth whitening is not an eligible expense. Since it is a cosmetic procedure, it would not typically be covered by HSA funds.

No, cosmetic dental procedures are not covered by HSA funds. Dental implants, for example, are only eligible if they are not for cosmetic purposes.

Typically, electric toothbrushes, and such items are generally considered personal care products, not medical expenses. Therefore, they are not covered by an HSA, but they could be if they are prescribed by a dentist. Speak with your dentist to get confirmation.

Sources

- American Dental Association. (2023, May 1). Dental filling options. MouthHealthy. https://www.mouthhealthy.org/all-topics-a-z/dental-filling-options (accessed May 12th, 2025)

- Kim, P. (2021, February 23). Average cost of dental insurance will scare you. CreditDonkey. https://www.creditdonkey.com/average-cost-dental-insurance.html (accessed May 12th, 2025)

- HealthCare.gov. (2023, May 1). How HSA-eligible plans work. https://www.healthcare.gov/high-deductible-health-plan/hdhp-hsa-work-together/ (accessed May 12th, 2025)

- Long, K. C. (2023, January 24). 9 facts about HSAs that might surprise your clients. Journal of Accountancy. https://www.journalofaccountancy.com/news/2023/jan/9-facts-hsa-that-might-surprise-your-clients.html (accessed May 12th, 2025)

- Internal Revenue Service. (2023, May 4). Publication 969 (2022), Health savings accounts and other tax-favored health plans. https://www.irs.gov/publications/p969 (accessed May 12th, 2025)

Smile Generation blog articles are reviewed by a licensed dental professional before publishing. However, we present this information for educational purposes only with the intent to promote readers’ understanding of oral health and oral healthcare treatment options and technology. We do not intend for our blog content to substitute for professional dental care and clinical advice, diagnosis, or treatment planning provided by a licensed dental professional. Smile Generation always recommends seeking the advice of a dentist, physician, or other licensed healthcare professional for a dental or medical condition or treatment.