Maintaining a healthier, happier smile is one of life’s great joys. It boosts confidence, enhances your appearance, and reduces the risk of disease.

Dental financing, however, isn’t quite as straightforward as flossing. Navigating financing terms can be puzzling, but it shouldn’t deter you from getting the essential care you need.

In-house dental financing, and medical/dental credit cards are some of the many special financing options you can use to ensure you have the funds to pay for the dental work you need. While there are convenient financing options for everyone regardless of credit, your credit score can greatly affect the benefits you receive from these special dental financing options.

Dental Promotional Financing Options

To make the most of promotional financing, it’s a good idea to understand the terms and definitions in the financing agreement. And remember, always take a moment to read the fine print so you’re fully informed – avoiding any unexpected debt is definitely worth the effort.

Making sure you’re in the dental chair at least twice a year is essential for maintaining optimal oral health. A dental credit line can be a solution to make that happen.

Here are some benefits of financing:

- Peace of mind: Studies show that financial stress can significantly impact both your mental and physical well-being.

- Better care: When you’re not worried about how to pay for dental appointments, you can give greater attention to the treatments you need.

- Help for uninsured patients: In 2021, over 31 million Americans were uninsured for medical expenses. Dental financing can help reduce your short-term out-of-pocket expense, so you don’t have to worry about paying for everything upfront.

As you explore various dental financing options, you might encounter unfamiliar terms. Understanding these definitions could greatly influence the plan you choose.

A few common special promotional financing offers and plans include:

- Deferred interest

- Fixed-rate line of credit

By familiarizing yourself with these phrases and understanding what they mean, you can make solid financial decisions when paying for dental work.

What Is Deferred Interest?

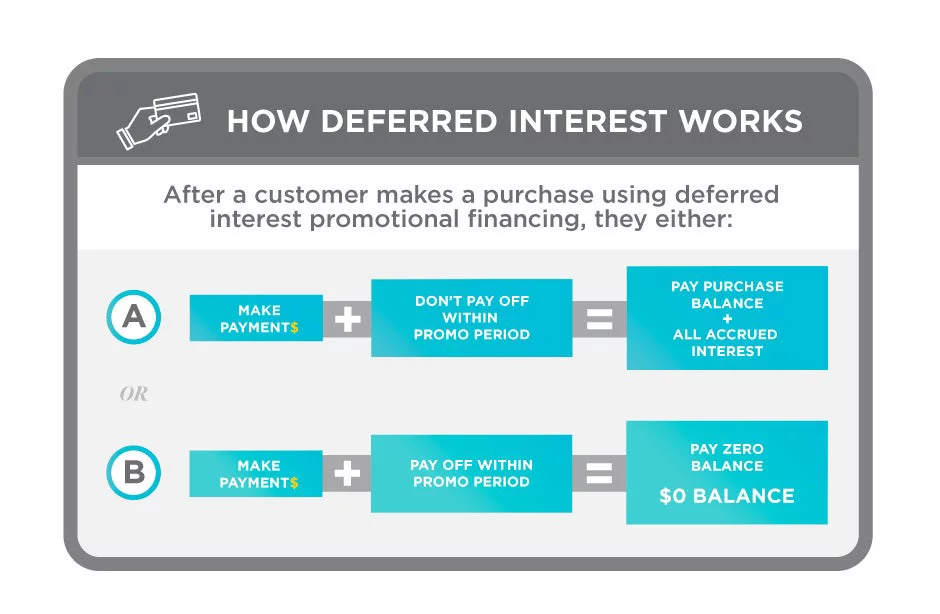

Deferred interest is when you’re not charged interest on a loan or line of credit during a specific period, often several months. However, if you don’t pay off the full balance within that promotional plan period, you might be retroactively charged interest from the purchase date, for the full purchase amount – no matter how much of the loan has been paid off.

When using a credit line to pay for dental appointments or procedures, you are essentially borrowing the money with a plan to pay it back in smaller monthly increments. Every month, you will accrue interest – which is a certain percentage of the amount still owed – on what you have borrowed until the amount is paid off in full.

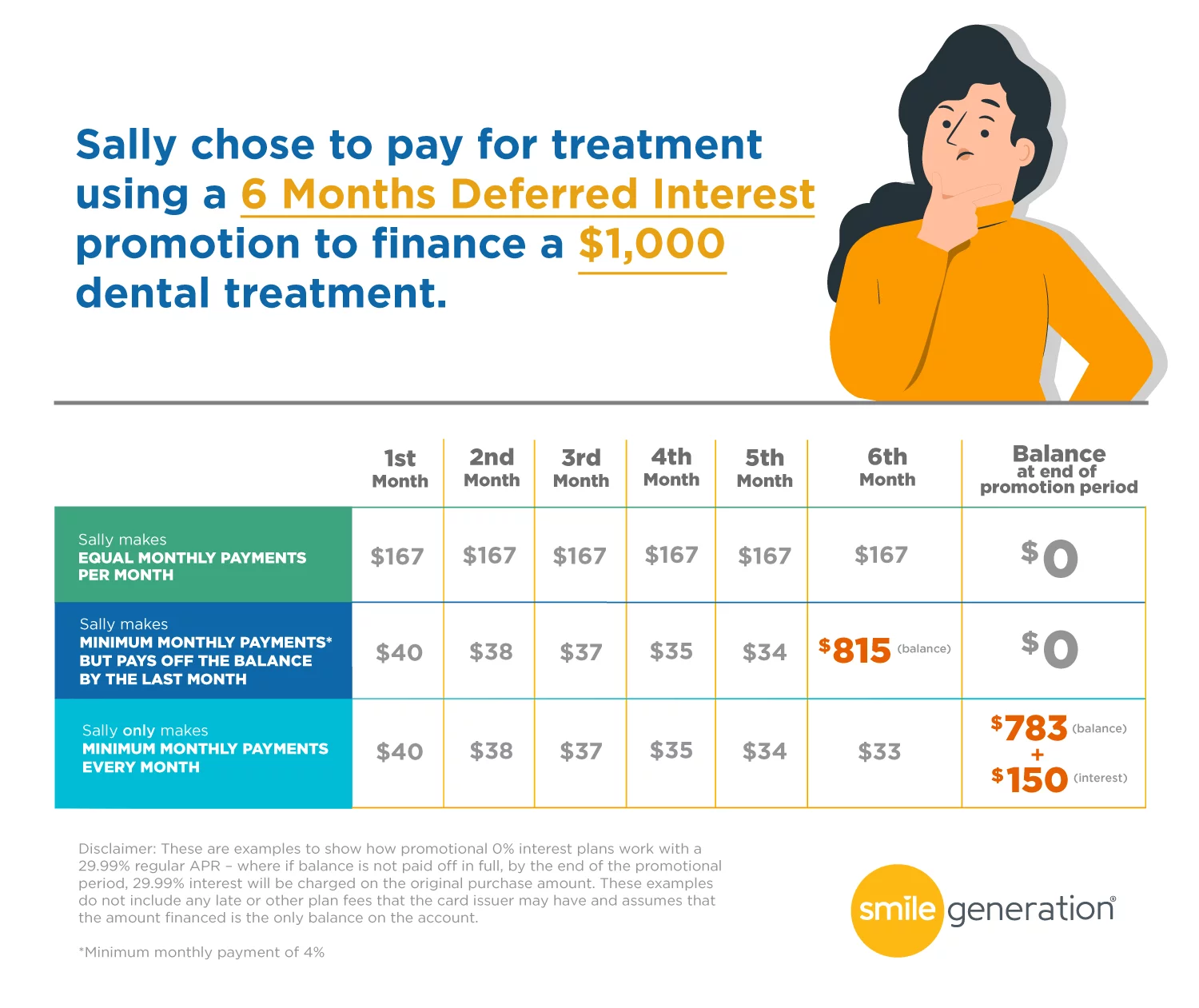

Here is an example of deferred interest:

Let’s say you’ve applied and been approved for a 0% promotional interest plan for $1,000 for 6 months. You’ll need to ensure you make any minimum monthly payment that may be required, or monthly payments of $167 for 6 consecutive months to pay the balance in full by the end of the promotional period. If the full $1,000 is not paid off by the 6th month, the standard APR will kick in on the original balance.

When you see advertisements for credit with 0% special promotional financing for 6, 12, 18 or 24 months, it may sound like a great idea, but you may leave yourself open to taking a big risk. One of the benefits of getting a loan or credit card with deferred interest is that it initially functions as an interest-free loan. If you pay the total off within the promotional interest-free period, you don't have to pay any additional interest. Many times, there are also monthly minimum payments required.

But a major disadvantage with deferred interest is that once the promotional period is over and if you still have a remaining balance, the interest that would have been charged during the “interest-free” time will be added to your initial amount.

The Advantages of Fixed-Rate Financing

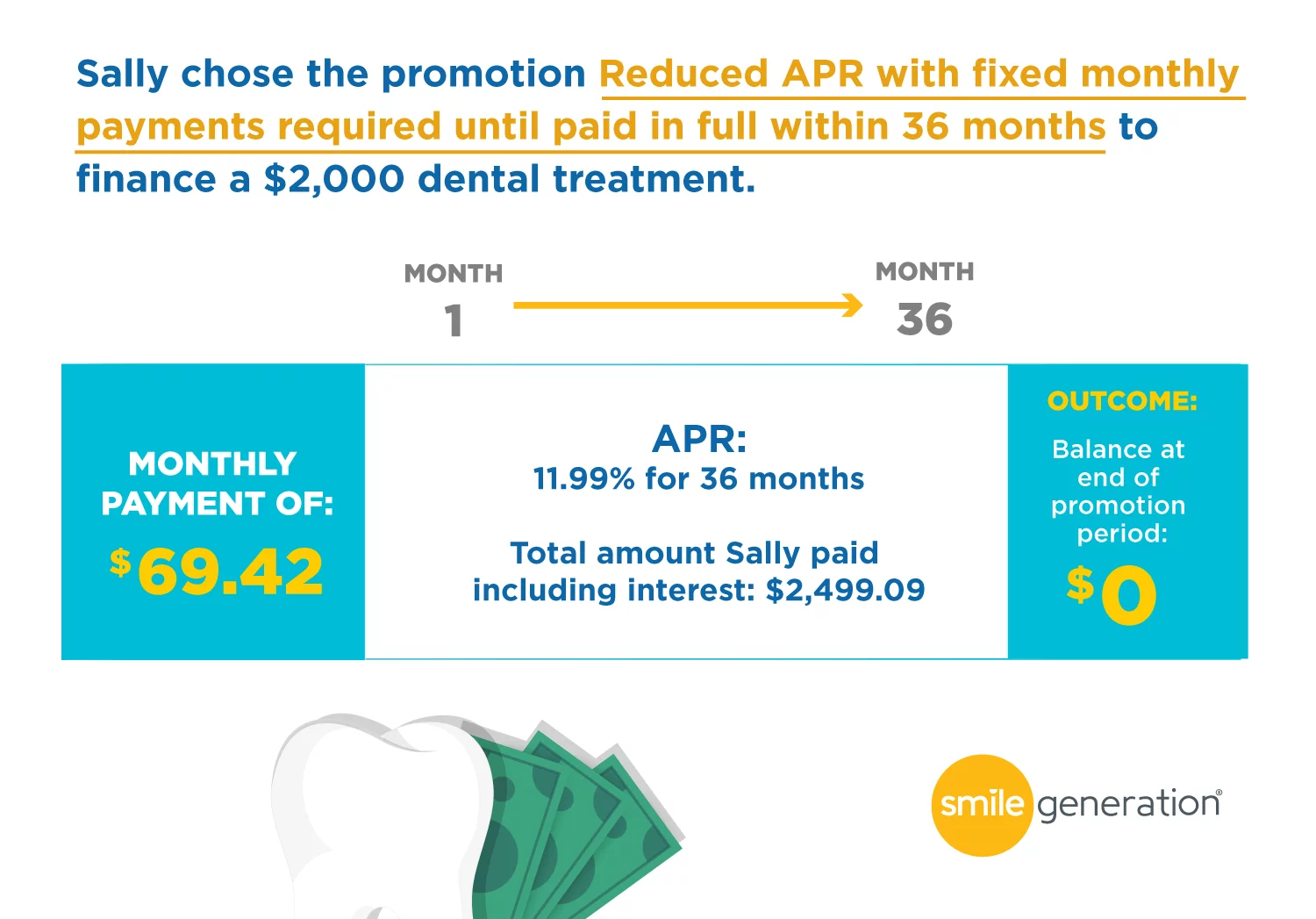

Variable or fixed-rate lines of credit often come with a promotional period, combining features of a standard line of credit and a fixed-rate loan. This type of loan product can help you avoid higher interest on larger dollar, longer-term loans if you’re able to pay a certain amount per month. Once the promotional period ends, the interest rate typically reverts to the standard APR.

Here's an example of fixed-rate financing:

More General Financing Terms

As you read the fine print of all repayment terms when exploring your financing options, a few definitions that are helpful to know include:

APR (Annual Percentage Rate)

You will likely come across these letters when discussing interest rates on loans or credit. This acronym stands for annual percentage rate, and it refers to the percentage of interest you will pay over the course of a year.

The remaining total that you owe.

A revolving preset amount of money an institution agrees to lend you with interest included in your repayment. You can spend the amount, pay it back, then spend it again, unlike a loan which is a one-time lump sum of money that must be repaid.

A prequalification offer is a soft-inquiry credit check, which doesn’t hurt your credit. It’s when a creditor looks at certain basic criteria to check to see if you are a potentially good candidate for that creditor’s card or loan. A prequalification approval does not always guarantee that a line of credit will be extended, as a hard credit inquiry will likely be required.

Smile Generation Financing Marketplace

With Smile Generation, you have financing options that fit your budget and what dental treatments you need to keep your teeth and gums healthy without straining your finances.

To qualify for patient financing, simply complete a pre-qualification application so that a soft credit check can determine which financing options are available to you.

If you want to find a dentist in your community who accepts Smile Generation's financing options, check out the Find A Dentist tool for trusted dentists in your area.

Find your trusted, local dentist today!

- Cohen, Robin A., Michael E. Martinez, M.P.H., Amy E. Cha, Emily P. Terlizzi, "Health Insurance Coverage: Early Release of Estimates From the National Health Interview Survey, January -June 2021." CDC, Nov. 2021, https://www.cdc.gov/nchs/data/nhis/earlyrelease/insur202111.pdf

- Ryu, Soomin, Lu Fan, "The Relationship Between Financial Worries and Psychological Distress Among U.S. Adults." NIH, 1 Feb. 2022, https://www.ncbi.nlm.nih.gov/pmc/articles/PMC8806009/

Smile Generation blog articles are reviewed by a licensed dental professional before publishing. However, we present this information for educational purposes only with the intent to promote readers’ understanding of oral health and oral healthcare treatment options and technology. We do not intend for our blog content to substitute for professional dental care and clinical advice, diagnosis, or treatment planning provided by a licensed dental professional. Smile Generation always recommends seeking the advice of a dentist, physician, or other licensed healthcare professional for a dental or medical condition or treatment.